Brandformance Marketing for Banks

In the competitive landscape of the banking industry, the convergence of branding and performance marketing has become increasingly crucial. This fusion, often referred to as “brandformance marketing,” represents a strategic approach that leverages both brand-building and performance-driven tactics to enhance a bank’s market presence, customer engagement, and overall business performance.

Understanding Brandformance Marketing

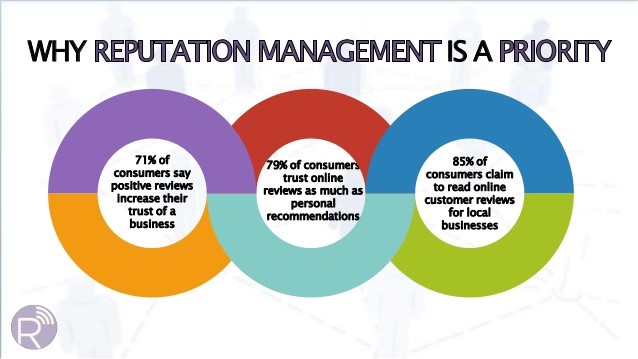

Brandformance marketing for banks involves aligning the institution’s branding efforts with measurable performance metrics. Traditionally, branding focuses on building a bank’s identity, reputation, and emotional connection with its audience. On the other hand, performance marketing emphasizes tangible outcomes such as lead generation, customer acquisition, and conversion rates. By integrating these two aspects, banks can create a cohesive strategy that not only enhances brand equity but also drives tangible business results.

Key Components of Brandformance Marketing

- Brand Consistency: Maintaining a consistent brand image across all marketing channels is essential for building trust and recognition. From social media presence to physical branches, every touchpoint should reflect the bank’s core values and messaging.

- Data-Driven Insights: Utilizing data analytics and customer insights allows banks to understand their audience better, personalize their marketing efforts, and optimize their campaigns for improved performance.

- Integrated Campaigns: Combining traditional brand-building initiatives with performance-driven tactics, such as targeted advertising and personalized promotions, creates a holistic approach that strengthens the brand while driving specific actions.

The Impact on Customer Engagement

Brandformance marketing not only elevates a bank’s visibility but also fosters deeper connections with customers. By conveying a consistent brand narrative while delivering personalized, relevant offers, banks can enhance customer engagement and loyalty. This approach helps in differentiating the bank from competitors, fostering trust, and ultimately increasing customer lifetime value.

Driving Business Performance

The synergy between branding and performance marketing directly impacts a bank’s bottom line. Through brandformance strategies, banks can effectively attract new customers, nurture existing relationships, and drive conversions. Moreover, by leveraging data-driven insights, banks can optimize their marketing spend, improve ROI, and achieve sustainable growth.

In conclusion, brandformance marketing represents a powerful strategy for banks seeking to strengthen their brand presence while driving tangible business outcomes. By unifying branding efforts with performance-driven tactics, banks can create a compelling narrative, deepen customer relationships, and achieve sustainable growth in an increasingly competitive market.